Finance

The Complete Story of Bitcoin (BTC) ETFs

Why Does the Whole Crypto Community Anticipate the SECs Decision?

Bitcoin (BTC) ETFs (Exchange Traded Funds) have lately taken over all crypto-related media in anticipation of the US SECs decision about the VanEck and SolidX rule-change filing.

It is being portrayed as if the price and the future of the number one cryptocurrency, and consequentially all the others’, depends exclusively on the bureaucrats’ decision to allow or not to allow the two associate companies to proceed with what they planned.

Why is VanEck-SolidX ETF Filing so Important?

Even the most basic research shows that VanEck’s ETF proposal is just one among more than 20 which were filed for the SEC approval, yet the hype has been going on for days, if not months.

The reason for the anticipation is that CBOE-VanEck-SolidX Bitcoin ETF seems to be solving all the issues that the SEC had mentioned when rejecting other proposals.

The official letter, signed by Jan van Eck ,to the director of the SEC’s division of investment management, Dalia Blass, answers the commission’s concerns with following arguments:

- The VanEck’s partnership states that prices from CBOE and CME are enough to adequately determine an ETF’s net asset value (NAV), which would calm the SEC’s valuation concerns.”

- Partners further explain that the Bitcoin market is very liquid, with an average trading spread of less than five basis points, and a total volume of the CBOE and CME coming up to $200 million.

- VanEck further states that their ETF will not invest in physically settled bitcoin contracts, but it could engage with market players to find a solution to satisfy direct custody requirements.

- Concerning the arbitrage, the letter explains that Bitcoin markets are not significantly more volatile than gold miner stocks or comparable equities. “We believe that neither the volatility nor the current volume in the bitcoin futures market will inhibit the creation and redemption process by authorised participants and that these creations and redemptions will keep the proposed ETFs market price in line with its NAV.”

- Market manipulation was a risk much emphasized by the SEC in their recent ETF rejections, but VanEck and SolidX declared that those risks would be overwhelmingly decreased if The King becomes a regulated product traded on a US exchange.

There are Other Applicants With Original Ideas

The SEC denied the Winklevoss brothers’ ETF application on July 26th, which triggered a one-day bear run when the price of Bitcoin briefly dropped from $8,280 to $7,800.

Nevertheless, other applicants didn’t lose hope.

The San Francisco-based asset management firm, Bitwise, filed the first of its kind proposition to launch a cryptocurrency index ETF with the SEC last week.

“The issues around an ETF, (namely) custody, liquidity, and market manipulation are similar for most of the large cap assets,” stated Hunter Horsely, the CEO, and co-founder of Bitwise on the CNBC’s Fast Money. He then concluded that “once you get comfortable with what it takes to do that effectively in crypto, our feeling is that you can do that for many different coins.”

The Bitcoin Bulls Believe That ETFs Hold the Key to 2018 Bull Run

According to the recent extensive research conducted by totalcrypto.io, which mainly compares Bitcoin to Gold, shows the high possibility of permanently positive market movement.

The report based on the research recapitulates how the value of gold spiked more than 400% in 8 years after the SEC approved the Gold ETFs on March 28th, 2003.

The report speculates that the same fate awaits Bitcoin if the SEC gives the green light for any of the filed applications because the research showed that 56% of high net-worth individuals are highly interested in investing in cryptocurrencies, along with 29% of millionaires.

Some of the VIPs Don’t Share the Excitement About the ETFs

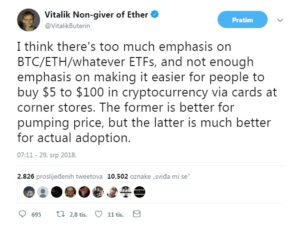

“I think there’s too much emphasis on BTC/ETH/whatever ETFs, and not enough emphasis on making it easier for people to buy $5 to $100 in cryptocurrency via cards at corner stores,” posted the founder of Ethereum (ETH), Vitalik Buterin on his official Twitter. He concluded that ETFs are better for pumping the price, while the latter is much better for actual adoption, which should be far more important.

“I think there’s too much emphasis on BTC/ETH/whatever ETFs, and not enough emphasis on making it easier for people to buy $5 to $100 in cryptocurrency via cards at corner stores,” posted the founder of Ethereum (ETH), Vitalik Buterin on his official Twitter. He concluded that ETFs are better for pumping the price, while the latter is much better for actual adoption, which should be far more important.

Aditya Mishra, the CEO of 108Token, seems to share the opinion of the young Messiah of Ethereum, as he deduced that cryptocurrency ETFs are focused on institutional investors. Therefore the average investor needs a simpler solution.

Whatever anybody says, all the hype and hope surrounding the long-awaited SEC’s ruling don’t seem to evaporate lightly. We should rather all learn to live with it because the already notorious SEC has postponed their decision-making deadline until September 21, 2018.

At least, this long waiting period will give all of us the time to adapt.

A round of applause for your post.Thanks Again.

Kudos! I value it.art college essay write my essay wanted freelance writers

Asking questions are truly good thing if you are not understanding anything entirely, but this post offers good understanding even.