Security

Report: Regulatory Uncertainty Causes Trouble to Blockchain Businesses in the UK

A report submitted by Digital Catapult and DLT Field Labs, titled Blockchain in Action: State of the UK Market, concluded that British distributed ledger technology firms seem to be concerned regarding the regulatory uncertainty found in the country’s blockchain sector.

The research support highlighted not only the opportunities that come with the adoption of blockchain technology and other DLT, but it also identified the challenges felt by businesses across the UK.

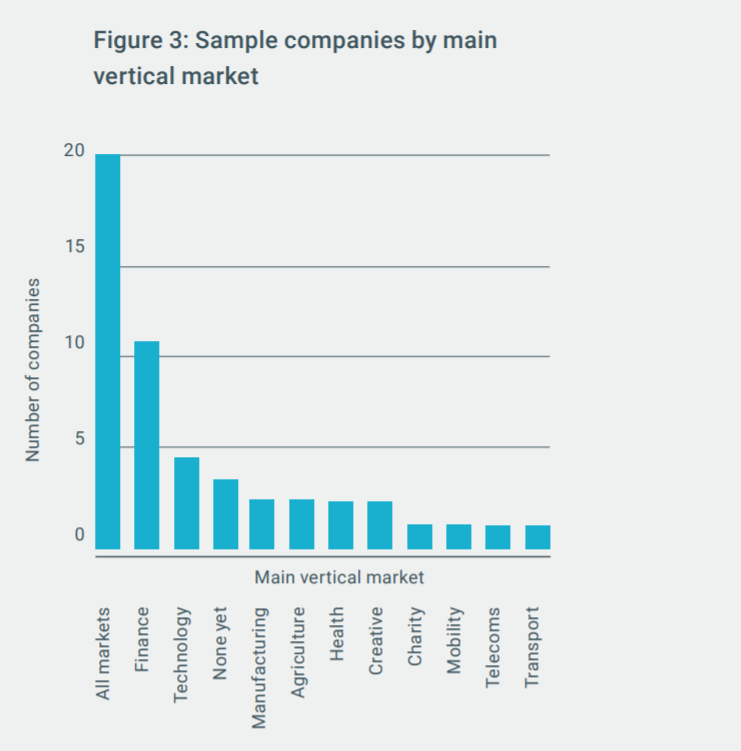

The digital innovation firm studied a mix of 264 DLT businesses in the country. About 74% of the participating companies were not happy with the current regulatory issues and highlighted it as one of their major concerns. Some other issues included a lack of access to business, legal, or technical expertise.

What Are These Regulatory Challenges

British companies appear to be facing a mix of challenges. The most prominent of them all is the European Union’s General Data Protection Regulation (GDPR).

Recent changes in the GDPR has left many European companies confused. The GDPR aims to unify how personal data is handled in the continent. The changing legislation, however, has become a challenge for companies that use blockchain technology since it stores data from all around the world.

The report from Digital Catapult said:

“This legislation raised concerns for companies using permissionless, public blockchains, which are open to anyone regardless of location, and where full copies of the database are replicated across all of the nodes participating in the network, making it impossible to selectively limit where the data goes.”

The Right to Erasure

The concept of GDPR comes into conflict with the proposal of a decentralised secured storage by the blockchain technology. That is because GDPR places control over personal data into the hands of citizens. They enjoy the right to delete their private data whenever they want to. This goes in contrast with how permissionless blockchains work as they keep data in an immutable state.

Reconciling these two has proven to be a big task for lawmakers and companies alike.

Concerns Regarding ICOs

There seems to be a lot of worries regarding Initial Coin Offerings (ICO) as well. According to the report, the UK has the second largest number of ICOs launched (10%), with the US in the first place with 20%.

While crypto-tokens as a way to raise funds through an ICO was seen as a way to raise “fair revenue shares for creative works”, it has caused a lot of companies to dwell in the midst of regulatory uncertainty.

The UK Financial Conduct Authority had earlier announced plans to regulate ICOs, but the organization is yet to issue a formal notice on the same.

This delay is causing companies to delay their ICO plans, which results in even more uncertainty. The report stated:

“This uncertainty was raised many times by the companies consulted, as they were unsure whether they should conduct an ICO in the UK or allow UK citizens to participate given the current regulatory landscape.”

The primary question is:

How to perform an ICO that is GDPR compliant and at the same time conforming to anti-money laundering laws, as well as compliant with Know-Your-Customer rules, if cryptocurrency transactions are meant to be anonymous?

More Issues Due to Uncertainty

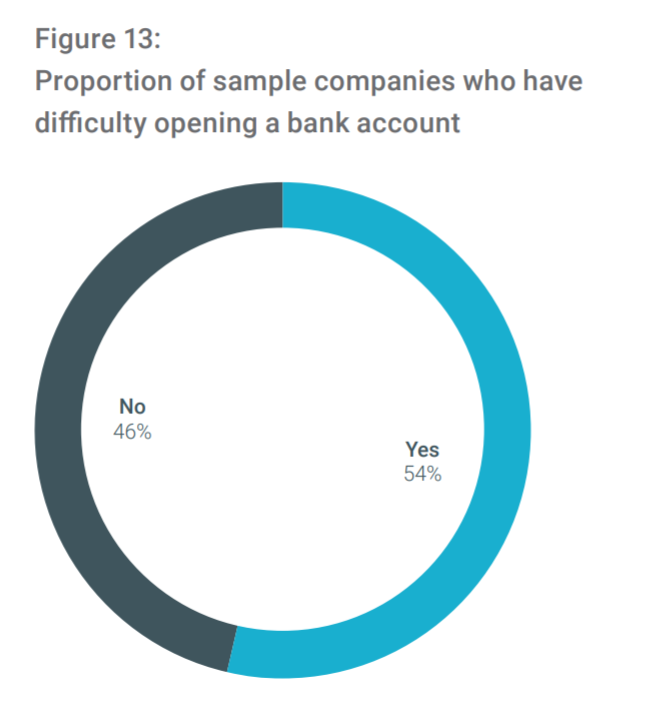

Of the 264 DLT firms surveyed, about 54% of the blockchain companies highlighted the difficulties when opening bank accounts with traditional financial organizations. That is due to the uncertainty regarding cryptocurrencies.

Also, the survey pointed about that funds raised in crypto-assets posed a tougher time for the firms, who were faced with obstacles opening accounts in spite of going through all AML and KYC checks. This has led them to open multiple accounts around the world.

Still Some Positivity

Despite all the concerns, the report concluded that the sector is growing at a good pace in the country. According to Digital Catapult, the DLT “landscape has revealed the potential of its nascent technology to disrupt industries across the country.”

It found a vibrant ecosystem in a wide range of industries in the UK, displaying different stages of developments. It said:

“…investments rose from just over $50m in Q3 of 2016 to $150m by Q2 of 2018 (with ICO-related investments topping $100m in Q4 of 2017 and fiat investments climbing to over $100m in Q2 of 2018).”

They hope that the UK will regain their leading position in the DLT field, as it was in 2015, after “smoothing out the road to success.”

Thanks for this article. I will also like to talk about the fact that it can possibly be hard if you are in school and starting out to initiate a long credit standing. There are many learners who are just trying to endure and have a lengthy or beneficial credit history can sometimes be a difficult factor to have.

An attention-grabbing discussion is worth comment. I believe that you should write extra on this matter, it won’t be a taboo subject but usually persons are not enough to talk on such topics. To the next. Cheers

What?s Going down i’m new to this, I stumbled upon this I’ve found It absolutely helpful and it has aided me out loads. I hope to give a contribution & assist different customers like its helped me. Good job.

Please let me know if you’re looking for a article author for your weblog. You have some really great articles and I think I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some material for your blog in exchange for a link back to mine. Please blast me an email if interested. Regards!

I am always searching online for articles that can help me. Thanks!

Via my examination, shopping for electronics online can for sure be expensive, nevertheless there are some how-to’s that you can use to obtain the best bargains. There are constantly ways to find discount promotions that could help make one to buy the best electronics products at the lowest prices. Interesting blog post.

whoah this blog is fantastic i love reading your articles. Keep up the great work! You know, a lot of people are looking around for this information, you could help them greatly.

whoah this blog is excellent i love reading your posts. Keep up the great work! You know, a lot of people are hunting around for this info, you can aid them greatly.

I think this is among the most vital info for me. And i am glad reading your article. But want to remark on some general things, The web site style is perfect, the articles is really excellent : D. Good job, cheers

Wow, amazing blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is magnificent, as well as the content!